To a large extent, thanks to Apple’s transition from x86 to Arm and Microsoft’s continuous support for both architectures, people have regained interest in using Arm processors on PCs.

At the end of last year, MediaTek expressed interest in entering the Windows market, gaining support from Microsoft, while there were reports that AMD and NVIDIA are considering providing Arm-based solutions for mobile PCs as early as 2025. With support from Microsoft and Apple, it seems natural for chip and system suppliers to support Arm-based PCs. However, since their launch, these two Arm-based platforms have had mixed results.

Has the tide finally changed for Arm-based PCs? For Apple, there’s no turning back: it’s committed to replacing x86. For Microsoft, the situation is more complex.

01

Decoding Microsoft’s Moves: Unveiling Their Strategy

Microsoft released Windows Runtime (WinRT) in 2015, enabling Windows support for the first time on the Arm architecture. While it could run on all Arm v7-compatible SoCs, the initial two were NVIDIA’s Tegra K1 and Qualcomm’s Snapdragon S4. After NVIDIA discontinued Tegra K1, Microsoft shifted towards Qualcomm and its Snapdragon SoCs starting in late 2016.

In 2020, Apple replaced Intel’s x86 SoCs in Mac PCs with its own M-series mobile SoCs, incorporating custom Arm-compatible CPU cores. Apple’s transition was relatively smooth due to its full-stack control, ranging from CPU design to the MacOS operating system. Consequently, Apple’s platform even swiftly surpassed traditional x86 platforms in overall performance and efficiency.

Although the initial Qualcomm-based Windows PCs were marketed as Always Connected PCs (AC PCs), offering slim fanless form factors, extended battery life, and cellular connectivity, Microsoft encountered difficulties in supporting many traditional (x86) Windows and third-party applications. The new architecture led to numerous Windows 10 updates before the issues were resolved. However, Microsoft did effectively leverage Snapdragon’s wireless connectivity to seamlessly support cellular and Wi-Fi communication, significantly enhancing the user experience of mobile PCs.

02

Unlocking Windows Support by Qualcomm: What You Need to Know

Microsoft’s ongoing partnership with Qualcomm includes an exclusive agreement set to expire in 2025. The initial Qualcomm-based PCs utilized the standard smartphone SoC, Snapdragon 835. Recognizing the need for different performance and power combinations in SoCs compared to standard smartphones, Qualcomm introduced the Snapdragon 8Cx series in 2019, pivoting towards designs centered around PCs.

In 2024, following Apple’s lead, Qualcomm will introduce a new series of mobile SoCs specifically designed for mobile PCs, incorporating high-performance custom Arm-compatible CPU cores and high-performance Neural Processing Units (NPUs) for AI processing.

According to Qualcomm, this new Snapdragon X Elite SoC will surpass its x86 competitors and Apple in terms of AI and overall computing performance. (These claims are challenging to verify as these competitors are also slated to launch new products within the same timeframe.)

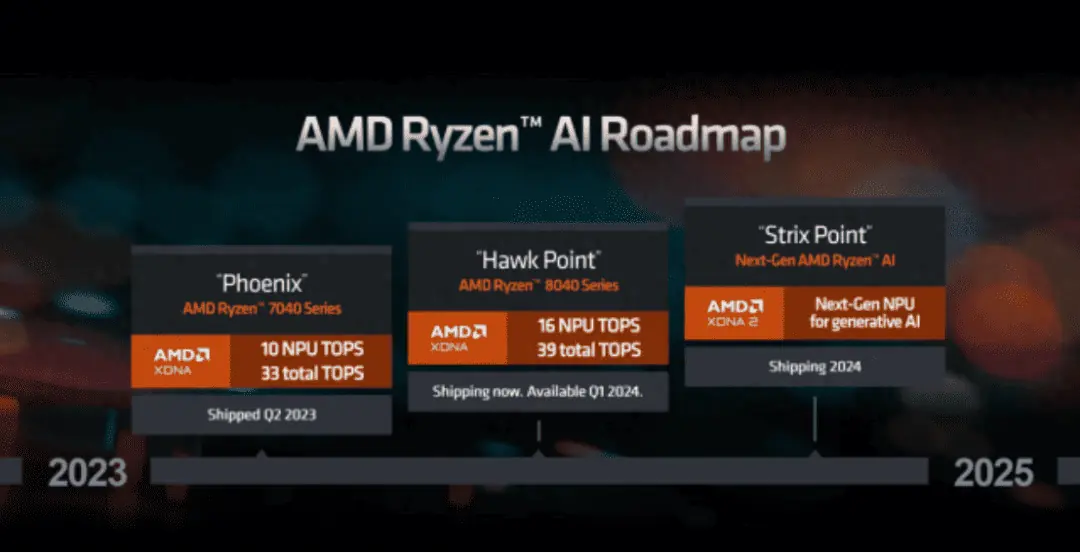

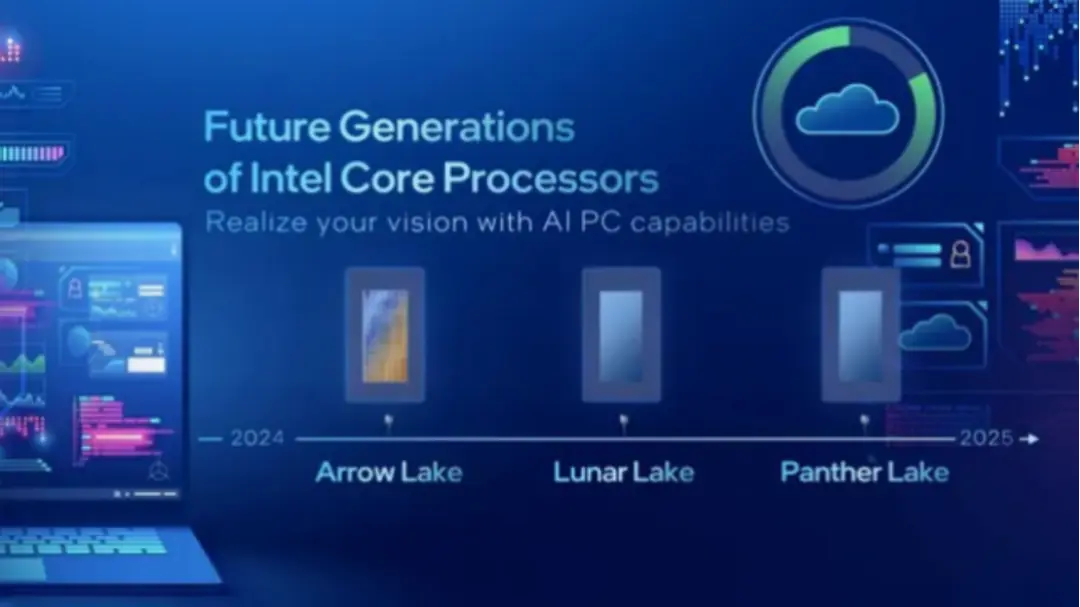

With AMD, Apple, Intel, MediaTek, and Qualcomm integrating NPUs into their PC SoCs, AI performance is becoming a crucial metric for future PCs, even for applications that utilize on-device AI processing. However, as Microsoft focuses on integrating its Copilot AI companion across all Microsoft applications and embedding AI capabilities into its suite of applications, AI processing performance will soon not only be a crucial metric but also a significant competitive advantage.

03

Learning from Experience: Key Lessons to Take Away

One of the early distinct features of Arm-based solutions quickly became their higher energy efficiency compared to contemporary x86 processors. Windows-based platforms could effortlessly achieve battery life spans of two days or longer. Additionally, most Arm-based Windows platforms typically came equipped with cellular connectivity. This became much like having a mouse or trackpad: once you have it, you never want to give it up.

The ability to connect almost anywhere without the need to search for Wi-Fi networks changed the game. Combining this feature with instant-on capabilities similar to smartphones, mobile PCs with full keyboards and larger screens became the preferred platform for many tasks typically performed on smartphones—responding to emails, watching YouTube videos, or even engaging in video chats with friends or colleagues.

Arm mobile SoCs also introduced smartphone AI inference processing into PCs through dedicated NPUs.

Both Qualcomm and Apple have extended their support for artificial intelligence through their initial mobile PC SoCs, which is an extension of their smartphone SoCs that have already utilized AI for battery management, computational photography, network connectivity, as well as third-party applications like video conferencing and social networks. It wasn’t until the latest generation of mobile x86 processors that AMD and Intel integrated NPUs into their mobile PC SoCs.

Although there are currently few applications effectively utilizing Windows PC NPUs, the market, and competition driven by Arm-based SoCs are focusing heavily on AI processing.

One thing still lacking in all other products except current Qualcomm SoCs is cellular connectivity. The cost for cellular connectivity in other platforms might reach hundreds of dollars, making the cost too high for all platforms except the highest-end system configurations.

Apple has also demonstrated that custom Arm-compatible cores can compete in performance with traditional x86 PC SoCs while emphasizing performance. Unfortunately, both Apple and Windows Arm-based PCs are significantly limited by the lack of support for high-performance discrete GPUs.

Similar to x86 SoCs with integrated graphics, Arm SoCs cater to most applications, but there are still high-performance applications such as gaming and STEM (Science, Technology, Engineering, and Mathematics) that require a good user experience provided by AMD, Intel, or Nvidia. In certain cases, advanced applications won’t run without a discrete GPU. However, Arm PCs can easily overcome this limitation through PCIe interconnects and GPU driver support.

04

Anticipating New Arm PC SoCs: What’s on the Horizon?

Among the three major chip companies interested in entering the Windows PC domain, only MediaTek has openly expressed intentions to venture into the mobile PC market using Arm SoCs but hasn’t provided any details. In the smartphone market, MediaTek solely employs standard Arm CPU cores, similar to what Qualcomm did before the upcoming launch of the Snapdragon X Elite PC SoC.

This strategy yields a highly efficient platform capable of achieving multi-day battery life but lags in overall performance, especially in CPU performance, compared to Apple and x86 competitors. It remains unclear whether MediaTek is willing to embark on the lengthy and costly path of developing its custom CPU core technology or if it plans to introduce standard Arm cores capable of delivering competitive PC performance.

Although neither AMD nor Nvidia confirm nor deny the development of Arm-compatible solutions, it seems plausible for both companies.

Both AMD and Nvidia hold Arm architecture licenses and have previously developed custom Arm-compatible cores. AMD developed custom Arm cores for its server processors, codenamed Seattle, although it was never officially released. Nvidia worked on its custom Arm-compatible cores for the Denver project aimed at smartphone SoCs. Project Denver also never saw a full market release, but Nvidia was among the first companies to run Windows on Arm processors with the Tegra K1 SoC. Note that Nvidia’s latest Arm server processor project is named Grace, using standard Arm Neoverse server cores.

Rumors surrounding AMD and Nvidia are appealing because these companies are leaders in the PC graphics domain, potentially enabling them to swiftly overcome the current graphical limitations of the Arm platform. Additionally, AMD has built custom SoCs for Microsoft Xbox gaming consoles, suggesting potential contracts with Microsoft or PC OEMs to build Arm SoCs for PCs.

Nvidia has also established a partnership with MediaTek for in-car SoCs. This collaboration merges MediaTek’s expertise in mobile/smartphone SoCs and wireless connectivity with Nvidia’s prowess in graphics and artificial intelligence. Although the current partnership focuses on in-car SoCs, similar efforts might apply to PC SoCs. Such a collaboration could position MediaTek ahead in graphics processing compared to other Arm-compatible PC SoCs.

If these three industry leaders are considering Arm-compatible solutions for PCs, other chip suppliers are probably contemplating the same. However, any company interested in entering this market must invest significantly in custom chip design and software development, requiring support from Microsoft. Even with support for instruction sets, porting the operating system to the platform is necessary. Therefore, only Microsoft can reveal which Arm-compatible SoCs will hit the market. However, Microsoft has stated its commitment to developing Arm-based PCs as a replacement for x86, a domain long dominated by Intel.

05

Is Investing Worth It? Unveiling the Potential Returns

While Arm-based PCs present compelling arguments, challenges persist. Apple continues to face challenges in graphics, integrated cellular connectivity, and traditional Windows PC application support. However, it has managed a relatively swift and seamless transition. On the other hand, Arm-based Windows PCs have been a market niche between Chromebooks and x86 PCs, without showing any momentum in seizing market share.

Despite Microsoft’s support and several OEMs offering PCs equipped with the latest Snapdragon, along with the advantages of Arm-based PCs, fundamental factors have hindered the platform’s adoption.

The first issue is visibility. These platforms are not widely available through many common retail channels, including the Microsoft Store, and are hardly visible on OEM websites. Just finding an Arm PC is already a significant challenge.

The second concern is software. Some legacy, highly specific applications may only run or run well on x86 PCs without substantial investment to port software to the Arm platform. Emulation serves many (but not all) applications, especially computationally intensive design and engineering apps. Apple still grapples with this challenge but is making strides to address it.

The third challenge is convenience in connectivity. Wireless carriers seem naturally inclined to sell these platforms with cellular connectivity, yet they haven’t shown significant interest. Until recently, carriers didn’t provide a straightforward method for initiating connections or offer cellular PC data plans consistent with other mobile devices. However, this situation might be changing. T-Mobile recently announced 90 days of free service for the new Microsoft Pro 9 PC with built-in eSIM technology featuring Qualcomm Snapdragon SoC.

The fourth crucial issue is differentiation. Arm PCs look and behave similarly to traditional x86 PCs. Besides not being overtly distinct, the platform lacks differentiation. Some early Arm-based PCs even had the same bloatware as traditional PCs, leading to performance issues and battery life constraints. Apart from integrated cellular connectivity, Arm Windows PCs currently don’t offer a unique user experience—something Intel has collaborated with MediaTek to add to x86 PCs. Without a unique experience, consumers and IT managers considering PC purchases are more likely to stick to familiar brands and technologies, especially when they’re the first items appearing in searches or web pages.

Another question arises: why would AMD and Nvidia consider entering the market with Arm-compatible SoCs or equipping Arm PCs with discrete graphics cards? Both companies’ success in the PC domain is closely tied to the x86 tradition, and the PC market is a mature market that may exhibit slow growth in the long run.

AMD’s and Nvidia’s investment in Arm PCs might imply diverting funds from one niche market to enter another. Particularly for AMD, which has seen significant success in the PC domain over the past few years, gaining market share. Entering the Arm PC domain necessitates significant investment in chip design and software development—a less-than-optimal strategy for companies that might face more intense competition from Intel in the future.

Intel has previously developed custom Arm cores. They developed the XScale architecture for smartphones, but this endeavor was sold to Marvell in 2006. Intel still utilizes standard Arm cores in various applications but has not shown interest in supporting Arm PCs. Intel’s CEO, Pat Gelsinger, recently responded to this potential threat, stating that it is “fairly inconsequential.”

06

Exploring Alternatives: Are There Other Options Available?

Developing custom CPU architectures is no easy feat, and efficiency can be enhanced by targeting specific Instruction Set Architectures (ISAs). However, this doesn’t exclude support for other ISAs.

Companies like Marvell with their Octeon processors and Synopsys with their recent Arc processors have demonstrated their ability to transition between different ISAs. The Octeon processor moved from MIPS to Arm, and Synopsys just launched a new Arc product line called Arc-V, supporting the RISC-V instruction set.

Therefore, if a company is investing heavily in developing custom CPU architectures for PCs, considering RISC-V might also align with their best interests. While the ecosystem isn’t mature, it offers more ISA flexibility and does not involve royalties or licensing fees. Of course, this still requires support from Microsoft, but it might be another option Microsoft should consider, especially considering China’s strong interest in RISC-V.

07

Unveiling the Future of Arm PCs: What Lies Ahead?

In the end, while there seems to be renewed interest in Arm-based PCs, the only sure success lies with Apple, which has made a definitive shift and shows no signs of turning back.

Despite efforts from Qualcomm and Microsoft, the Windows ecosystem hasn’t effectively driven widespread adoption of Arm PCs.

The Windows ecosystem for Arm PCs requires more support from OEMs, carriers, and even retail channels to influence consumer and enterprise buying patterns. Arm-based Windows PCs have become a reality, but they offer little differentiation from x86 PCs, which limits their impact on the market. However, this hasn’t deterred Microsoft and Qualcomm from investing in Arm-based Windows PCs.

Similarly, Microsoft continues to invest alongside other members of the x86 community to develop more competitive solutions.

Time will tell whether, in the second wave of interest in Arm-based PCs, the Windows ecosystem will coalesce around alternatives to x86 PCs.

Related:

- AI PCs Unveiled: Do Everyday Users Need to Upgrade?

- Arm: Collaborating for a Greener, More Sustainable Tomorrow