Malaysian Prime Minister Anwar unveiled the country’s “National Semiconductor Industry Strategy” (NSS) at the launch of the “2024 Southeast Asia Semiconductor Expo” on May 28, 2024. The plan aims to provide at least RM25 billion (approximately $5.3 billion or RMB38.53 billion) in direct subsidies to the country’s semiconductor industry and attract at least RM500 billion (approximately $106.2 billion or RMB770.5 billion) in domestic and foreign corporate investment, primarily targeting key areas such as chip design, advanced packaging, and semiconductor manufacturing equipment.

Malaysia hopes to leverage the $5.3 billion semiconductor subsidy to drive about $106.2 billion in semiconductor investments. Although the $5.3 billion subsidy is not substantial, Malaysia’s key position in the semiconductor industry chain, its local industry cluster advantage, and cost advantages—especially amid the impact of the US-China tech war and geopolitical conflicts—have made it a strategic location for many semiconductor manufacturers diversifying their supply chains.

1. Malaysian Semiconductor – Three Phases, Five Goals

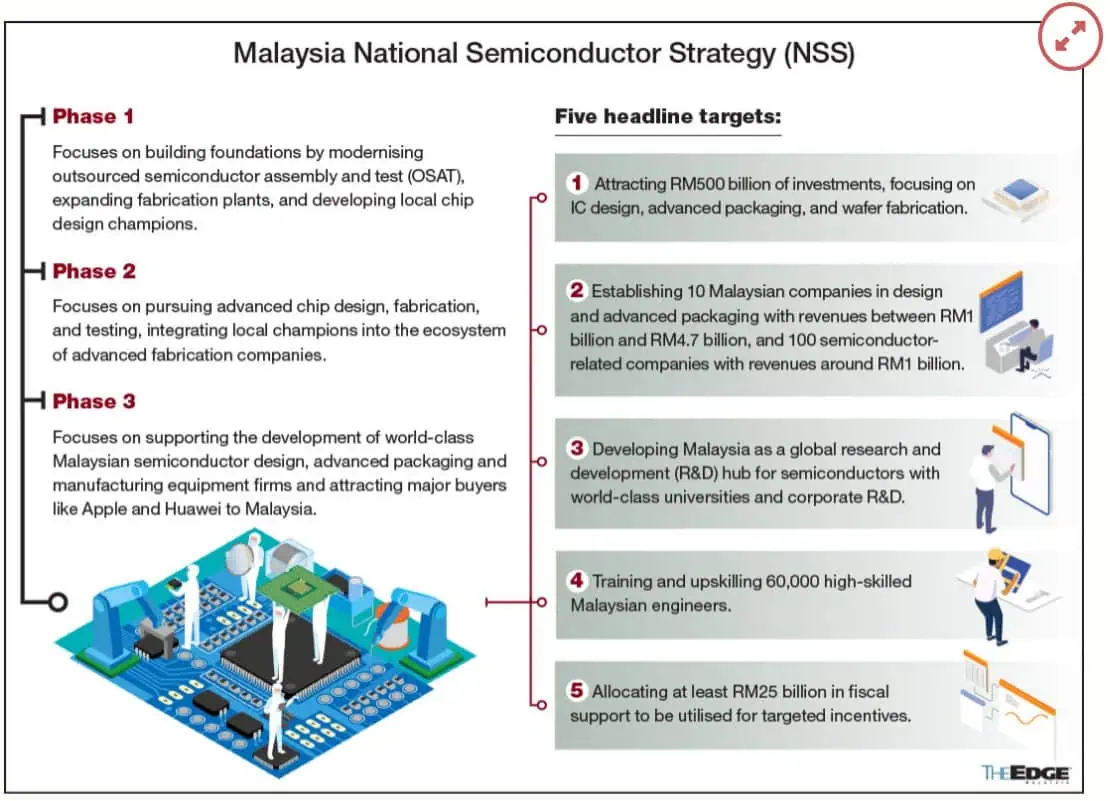

Specifically, the NSS, led by the Ministry of International Trade and Industry (MITI), will be implemented in three phases:

- Phase 1: Utilize Malaysia’s existing industry capacity and capabilities to support the modernization of outsourced semiconductor assembly and testing (OSAT).

- Phase 2: Focus on the design, manufacturing, and testing of cutting-edge logic and memory chips.

- Phase 3: Continue to increase investment to support Malaysian companies in becoming world-class semiconductor design, advanced packaging, and manufacturing equipment firms.

Based on these three phases, the Malaysian government has also proposed five goals:

- Attract RM500 billion in investment focused on IC design, advanced packaging, and wafer manufacturing. Domestic direct investment (DDI) in Malaysia will primarily focus on integrated circuit (IC) design, advanced packaging, and semiconductor manufacturing equipment, while foreign direct investment (FDI) will emphasize wafer manufacturing and semiconductor manufacturing equipment. Notably, to develop the local IC design industry, Malaysia has launched two IC design parks in Selangor and Penang to enhance the country’s global position in the design field, promote economic growth, and create high-value jobs. The Selangor IC Design Park will boost Malaysia’s position in the global industry, while the new 1 million square foot IC design and digital park at the Batu Kawan Industrial Park in Penang highlights the state’s commitment to innovation, industry growth, and talent attraction.

- Establish at least 10 local chip design and advanced packaging companies with revenues between RM1 billion to RM4.7 billion, and at least 100 local semiconductor-related companies with revenues close to RM1 billion, creating higher wages for Malaysian workers.

- Collaborate with world-class universities and companies on R&D to develop Malaysia into a global semiconductor R&D center.

- Train and upskill 60,000 highly skilled Malaysian engineers.

- Allocate at least RM25 billion in fiscal support for targeted incentives.

Anwar also stated that to reaffirm Malaysia’s commitment to becoming a global leader in the semiconductor industry, the National Semiconductor Strategy Task Force (NSSTF) will collaborate with the Center for Engineering, Science, and Technology (CREST) under MITI, focusing on promoting innovation, enhancing R&D capabilities, and driving the commercialization of semiconductor technologies.

“To maintain flexibility and agility, the NSS will be a dynamic document that evolves as needed, but we remain steadfast in our ambition to make Malaysia a global major player in the semiconductor industry, providing accessible technology for all,” Anwar added.

2. Accelerated Growth of Malaysia’s Semiconductor Industry Amid US-China Chip War

Although Malaysia is not traditionally considered a technological powerhouse, it is one of the world’s top seven semiconductor product exporters and a major center for global semiconductor packaging and testing.

According to United Nations data, Malaysia has consistently held a leading position in global integrated circuit exports since 2002. In 2018, Malaysia’s integrated circuit export share surpassed Japan’s, equaling that of the United States.

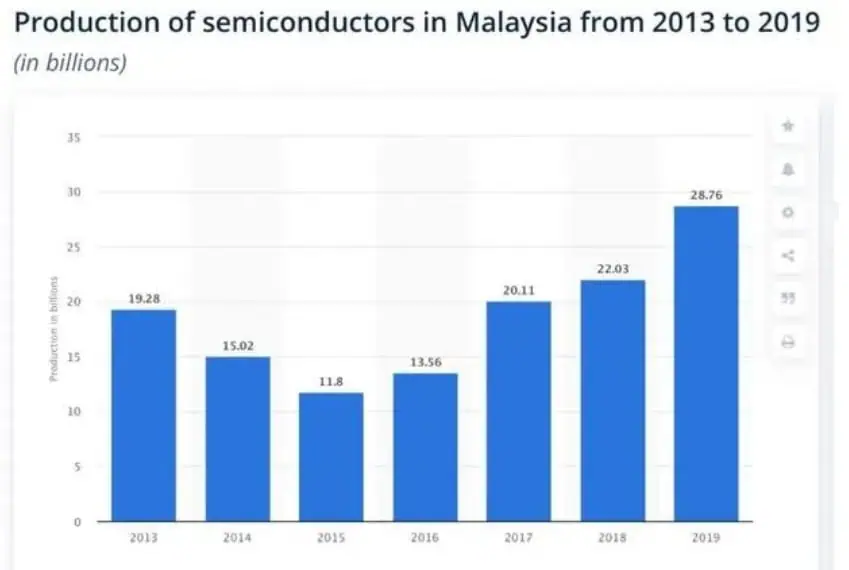

Southeast Asia holds a 27% share of the global packaging and testing market, with Malaysia alone contributing half of this (13%). According to Statista, Malaysia’s semiconductor packaging and testing revenue has shown rapid growth since 2015, reaching $28.76 billion in 2019. In addition to packaging and testing, Malaysia also has some locally designed, produced, and sold IDM companies.

Currently, Malaysia hosts over 50 major semiconductor companies, most of which are multinational corporations (MNCs) including Intel, AMD, NXP, Texas Instruments, ASE, Infineon, STMicroelectronics, Renesas, Nexperia, ASE, X-FAB, AVX, Nippon Chemicon, Panasonic, and Murata. These companies have established their own packaging or component manufacturing plants locally. Besides international firms, Malaysian local packaging and testing companies include Inari and Unisem (acquired by China’s Huatian Technology for RMB 2.992 billion in 2018). Additionally, Taiwanese passive component manufacturers such as Yageo, Walsin Technology, Chilisin, and AEM have factories in Malaysia.

In recent years, the COVID-19 pandemic, the US-China trade war, and a series of US export control policies limiting China’s semiconductor industry have triggered a global semiconductor supply chain reorganization. Increasingly, semiconductor manufacturers are investing more in Malaysia due to its semiconductor manufacturing cluster advantages.

For instance, in December 2021, Intel announced a $6.46 billion investment in Malaysia to expand its advanced packaging capacity in Penang and Kedah;

In December 2021, Japan’s Rohm Semiconductor announced the construction of new facilities at its Malaysian subsidiary to expand its analog LSI and transistor production capacity;

In December 2021, Nexperia began constructing a new backend factory in Seremban, Malaysia, to increase its power semiconductor capacity by 85%;

In February 2022, Infineon announced an investment of over €2 billion to build a third plant at its Kulim facility in Malaysia for the production of silicon carbide (SiC) and gallium nitride (GaN) power semiconductor products;

In May 2022, Malaysian tech company Dagang Nexchange announced an MOU with Foxconn subsidiary BIH to establish a joint venture to build and operate a 12-inch wafer fab in Malaysia, with a planned monthly capacity of 40,000 wafers, focusing on 28/40nm mature processes;

In November 2022, Taiwanese packaging and testing giant ASE announced the construction of new semiconductor packaging and testing plants (Plants 4 and 5) in Penang, Malaysia, with completion expected by 2025. ASE plans to invest $300 million over five years to expand its Malaysian production facilities, procure advanced equipment, and train more engineering talent.

In June 2023, Texas Instruments announced an RM14.6 billion investment to build semiconductor packaging and testing plants in Kuala Lumpur and Melaka, with the two plants expected to begin production as early as 2025;

In August 2023, Bosch announced the opening of a new chip and sensor testing center in Penang, Malaysia, at a cost of approximately €65 million. Bosch plans to invest an additional €285 million by the mid-2030s.

According to the Financial Times, Malaysia’s foreign direct investment reached $12.8 billion in 2023, surpassing the total from 2013 to 2020.

Recent data shows that Malaysia’s electrical and electronics industry accounts for 13% of the global backend semiconductor industry and 40% of the country’s exports, contributing approximately 5.8% to Malaysia’s GDP in 2023.

To develop its semiconductor industry, Malaysia has previously promoted the National Industrial Master Plan (NIMP) 2030, aiming to develop more front-end manufacturing capabilities, such as integrated circuit design, wafer manufacturing, and semiconductor machinery and equipment manufacturing. The newly introduced National Semiconductor Industry Strategy further refines the implementation steps of this plan and provides funding support.

“Today, I position our country as the most neutral and non-aligned semiconductor production location to help build a safer and more resilient global semiconductor supply chain,” Anwar emphasized. “Whether you are an investor, sovereign wealth fund, manufacturer, engineer, or policymaker, we welcome you to join our transformative journey to create a more inclusive, resilient, and impactful semiconductor future for Malaysia and the world.”

Related:

- Samsung Delays Texas Chip Plant Equipment Order

- Future of Semiconductor Industry: Insights Ahead After 2024

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please contact us through the provided channels.