On October 1, 1847, a young man named Werner von Siemens and his friend Halske founded a German electrical company called ‘Siemens & Halske,’ which later became Siemens AG. In 1848, Siemens and Halske constructed the first long-distance telegraph line in Europe, marking their official entry into the industry.

In the 1950s, the emergence of computers and semiconductors prompted Siemens & Halske Company to begin exploring the production of related computer and semiconductor equipment.

In 1977, the company collaborated with Advanced Micro Devices (AMD) to enter the U.S. market and established Advanced Micro Computer (AMC) in Silicon Valley and Germany, initiating the development of microcomputers. In the 1990s, Siemens acquired several electronics companies with diverse product categories in the industry. In 1999, the company underwent a spin-off and established Infineon Technologies.

The Internet revolution of the previous century, particularly in the 1990s, triggered a surge in demand for both mainframe computers and personal computers, consequently driving a robust need for memory. This demand was so significant that major manufacturers began constructing semiconductor fabrication facilities, leading to an oversupply situation from 1996 to 1998. This excess supply caused a decline in memory prices.

As a result of this impact, the semiconductor subsidiary of Siemens announced a pre-tax revenue loss of $674 million for the fiscal year 1998. Chairman Heinrich von Pierer went as far as stating:

So, to safeguard itself, on April 1, 1999, Infineon Technologies officially spun off from Siemens Semiconductor, becoming an independently operated company.

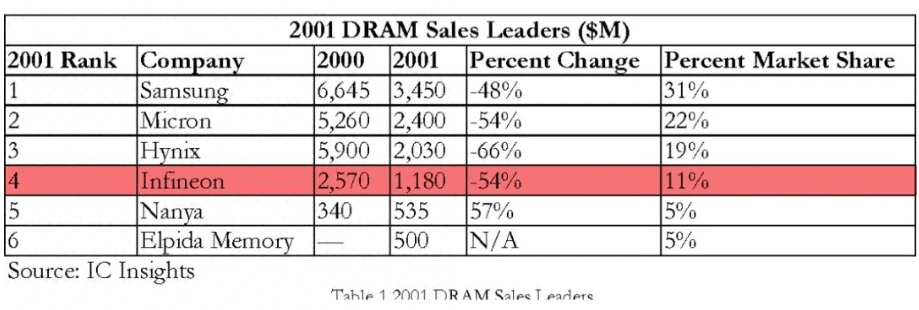

On the other hand, apart from the instability factors in the industry, one of Infineon’s distinct advantages as an independent entity was its ability to inherit the vast customer base and technology from its parent company. This gave Infineon the confidence to quickly become the world’s fourth-largest DRAM manufacturer, the second-largest semiconductor manufacturer in Europe, and one of the top ten semiconductor manufacturers globally.

Compared to its parent company’s $8 billion loss, Infineon, due to its impressive performance, managed to achieve a profit of $70 million in its first fiscal year. As a result, the company officially went public and was listed in the year 2000.

One of the reasons that Infineon managed to earn profits in 1999 was the alleviation of the earlier sluggish DRAM market conditions.

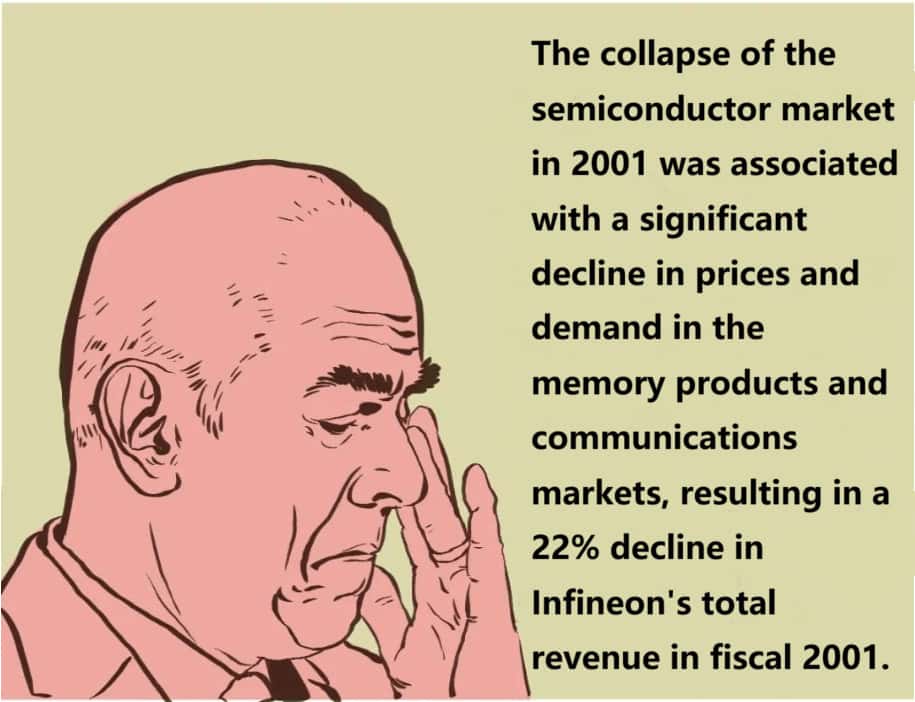

However, the good times didn’t last long as the year 2000 witnessed the global Internet crisis, leading to a significant decline in the PC market. At that time, major industry leaders including Infineon had just expanded their production capacities, resulting in an oversupply situation that caused a sharp drop in DRAM prices. In 2001, the scale of the DRAM market plummeted from $28.8 billion to $11 billion.

At that time, Infineon had three major divisions: Communications, Automotive Electronics, and Memory. However, memory chips became the least-performing division of the company.

Chief Executive Officer and President Ulrich Schumacher expressed in a letter to the shareholders on the company’s website:

By the year 2005, the consecutive decline in the memory chip market directly led to Infineon’s losses surpassing 2 billion euros (2.3 billion dollars). In an effort to stem the losses, in 2006, Infineon decided to spin off the unprofitable memory division, allowing the company to focus on more stable and profitable endeavors such as automotive chips.

The company that emerged from this spin-off was Qimonda, the largest DRAM manufacturer in Europe, with a lifespan of only three years.

Prior to 2015, as one of the European chip giants, Infineon held a dominant position in the global automotive semiconductor industry. However, this changed when NXP made a significant move by acquiring Freescale in 2015, displacing Infineon from its top spot in the automotive chip sector. In an effort to regain market prominence, Infineon also sought to make a substantial move by attempting to acquire another “European chip giant,” STMicroelectronics. However, due to its substantial influence, the proposed merger faced opposition from European antitrust regulators and governments. Consequently, this ambitious union did not come to fruition. Otherwise, the “European chip giants” would have become a “European duopoly.”

Today, Infineon stands as a global leader in power semiconductor devices and automotive semiconductors, maintaining a strong presence in the automotive and industrial markets. Its business encompasses four main segments: Automotive Electronics, Zero Carbon Industrial Power, Power and sensor Systems, and Secure Connectivity Solutions. According to market research firm Strategy Analytics’ 2021 data on the automotive semiconductor market, Infineon holds the top position with sales amounting to $5.725 billion, closely followed by NXP and Renesas.

Recommended Reading:

- ASML New Semiconductor Equipment Ban: Full of Risk?

- Exploring the Path of Toshiba After Semiconductors

- Infineon Launches Construction of Thai Power Module Plant

Disclaimer: This account maintains a neutral stance on all original and reposted articles, and the views expressed therein. The articles shared are solely intended for reader learning and exchange. Copyright for articles, images, and other content remains with the original authors. If there is any infringement, please contact us for removal.