JPMorgan points out that a continuous shortfall in data centers over the next four years will enhance their bargaining power, leading to increased leasing prices.

The market consensus is a “shortage of computing power,” but large data centers may face an even greater shortage, which is expected to persist. In a recent report, JPMorgan noted that the supply of data centers over the next four years will fall significantly short of downstream AI demand. More importantly, this persistent shortfall will boost data centers’ bargaining power, resulting in higher leasing prices.

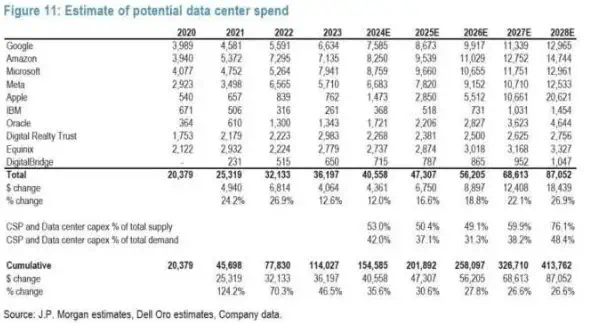

Based on capital expenditure estimates for data centers from major cloud computing and networking companies, JPMorgan projects data center build-out capacity for the next four years.

Assumptions for the calculations include:

- Data center construction spending in 2024 might range between $75 billion and $115 billion.

- From 2024 to 2028, the construction rate will grow by 19% annually.

- 25% of cloud spending will be allocated to data center construction, with costs ranging from $10 million to $15 million per megawatt (MW).

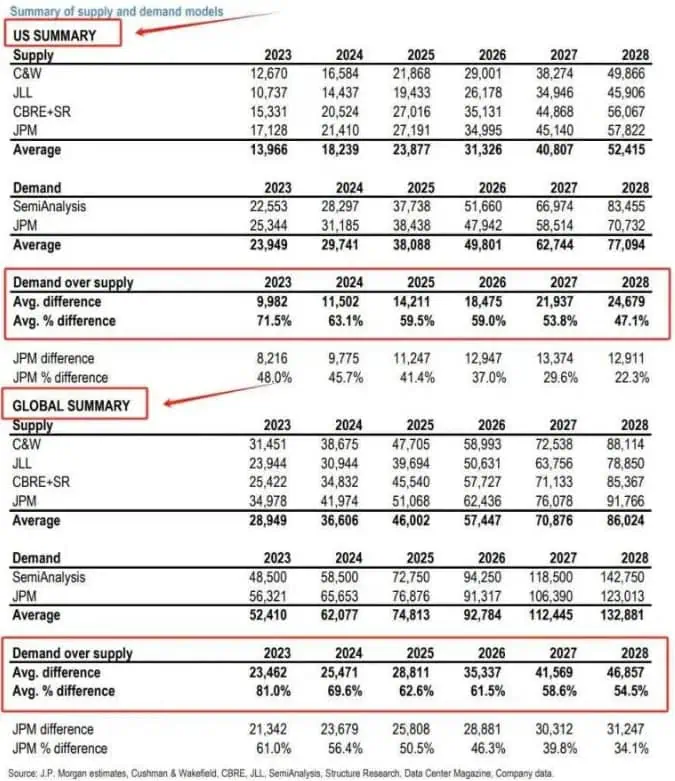

The estimates indicate that future data center capacity gaps will be:

- U.S. Market: A 2GW (gigawatt) shortfall in 2024, increasing to 3GW in 2025, and reaching 4GW in 2026.

- Global Market: A 2GW shortfall in 2024, increasing to 3GW in 2025, and reaching 7GW in 2026.

JPMorgan states that due to the strong downstream AI demand and the ongoing shortfall in data centers over the next four years, data center leasing prices are expected to rise.

According to JPMorgan’s calculations, the shortfall will be most pronounced in 2025 and 2026, with some alleviation expected after 2026, although the market will still remain imbalanced.

JPMorgan also highlights several major factors hindering data center development, including limited available land, higher capital costs, equipment limitations, licensing and zoning approvals, power generation and transmission issues, and labor supply and costs.

The report also notes that this significant supply-demand gap creates opportunities for investors, especially in large data centers.

Disclaimer: This article is created by the original author. The content of the article represents their personal opinions. Our reposting is for sharing and discussion purposes only and does not imply our endorsement or agreement. If you have any objections, please get in touch with us through the provided channels.