According to Nikkei Asia on May 15, due to sluggish new car sales, Honda’s China factory will soon lay off 1,700 employees.

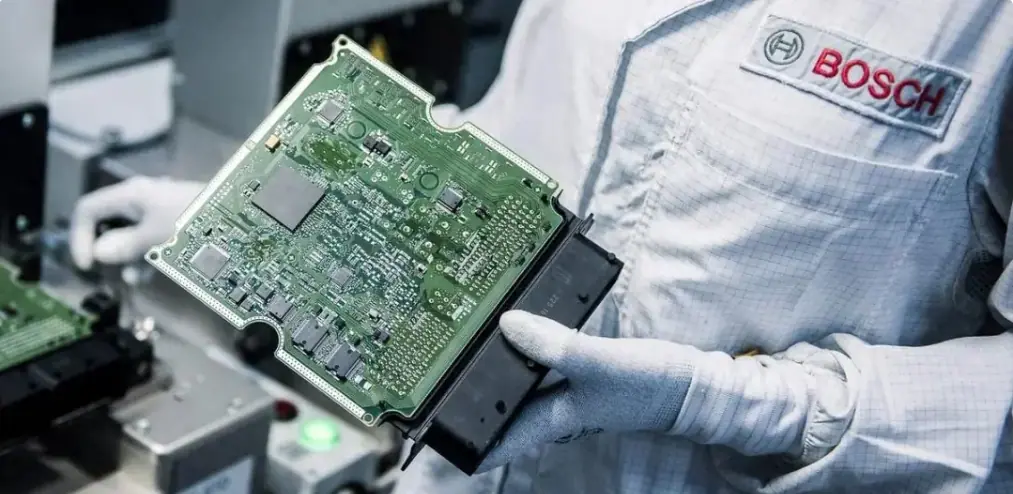

The automotive electronics giant has also confirmed laying off 1,200 people, reflecting a shrinking market for fuel car suppliers such as Bosch, Continental, and ZF. This downturn has impacted the already sluggish automotive chip supply chain, with major chip manufacturers like Infineon, NXP, and ST recently reporting slowed growth in the automotive market for the first quarter.

Nikkei News exclusively reported that Honda, faced with sluggish new car sales in China, has initiated voluntary retirement measures for its full-time employees at the Chinese factories since May. It’s reported that the targeted employees for layoff are those related to production operations.

So far, approximately 1,700 employees (accounting for 14% of the workforce) have applied for voluntary retirement at GAC Honda, a joint venture between Honda and Guangzhou Automobile Group. Nikkei News predicts that due to severe sales shortfall, Honda may also reduce factory working days in June.

As China’s domestic electric vehicle (EV) penetration rate dramatically increases, joint venture car manufacturers and some Tier 1 suppliers are facing shrinking demand. However, the overall demand for chips in electrification and intelligence is expected to rise. These chip orders are likely to flow to Tier 1 suppliers, car manufacturers, and new players who are transitioning quickly.

The report points out that the Chinese market is currently centered on EVs, with intense price competition, leading Japanese car manufacturers to struggle in sales. In April, Honda’s new car sales in China dropped by 22.2% compared to the same month last year, Toyota decreased by 27.3%, and Nissan shrank by 10.4%.

Meanwhile, Honda currently sells cars in China through joint ventures like GAC Honda. The sales target for Honda in the Chinese market for the fiscal year 2024 (April 2024-March 2025) is 1.06 million units, down 13% from the previous year, and a significant 40% decrease compared to the historical peak in fiscal year 2020.

Previously, there were reports that Honda is considering reducing the annual production capacity of its Chinese factories by around 20% to approximately 1.2 million units. Additionally, Nissan plans to significantly reduce its automotive production capacity in China. Nissan’s Chinese factories currently have an annual production capacity of around 1.6 million units, and the company is considering reducing capacity by up to 500,000 units, approximately 30% of the annual capacity.

On May 8, Infineon, the world’s largest automotive chip supplier, confirmed plans to cut a three-digit number of jobs at its Regensburg plant in Germany as part of its announced austerity measures.

Infineon CEO Jochen Hanebeck stated, “Many end markets remain weak due to economic conditions, and customers and distributors continue to reduce semiconductor inventory levels. Demand for consumer applications remains weak, and the growth in the automotive industry has also slowed significantly.” Facing prolonged weak market demand, Infineon has also lowered its full-year revenue growth expectations.

Source: https://cn.nikkei.com/industry/icar/55605-2024-05-15-09-23-39.html